This Content Is Only For Paid Subscribers

In Part 2, McKinsey & Company’s Phil Kirschner and Ryan Luby explore the impact of the labor market’s shift towards flexible work and increasing independent work to 30-40% of the US labor force and the resulting influence on office spaces.

Every little extra step, every little point of friction along the way just makes it easier to be like ‘don’t want to’.

– Phil Kirschner, Senior Expert and Associate Partner, McKinsey & Company

It’s only when you look at this particular subset of class A, which you think about as you could call it trophy or magnet, do we see really persistent levels, high levels of attendance.

– Ryan Luby, Senior Knowledge Expert and Associate Partner, McKinsey & Company

Summary

In the past three years, the labor market has seen a significant shift in the bargaining space between employees and employers, with a focus on flexibility in where, when, and how work is performed, leading to a rise in independent work comprising 30 to 40% of the US labor force; this transformation is expected to endure over the next decade, impacting workplace demand and necessitating a reevaluation of office spaces and their purposes, emphasizing the need for responsive, data-driven strategies to create enduring and meaningful work environments.

Transcript

The Bargin (01:14)

Ryan Luby: Part of what’s most interesting over the last three years from a labor market perspective, it’s in some sense how much the bargaining space between employees and employers has opened up. Historically, and this is a little bit stylized, employees and employers have basically bargained over wages and hours. It’s been interesting over the last few years it’s been you have wages and hours, it’s table stakes, but you now have flexibility in terms of where, when, how is work performed. And I think as we think about what that means, it’s just a very nice framing for thinking about flexibility, which includes the built environment and the extent to which it seamlessly creates and facilitates flexibility across a workforce. The extent to which that does act as a competitive advantage in an increasingly tight talent and labor market. I think that’s part of the piece that we really see enduring is coming out of over the next 10 or 15 years. A world in which the bargaining space between employees and employers is more dynamic, occurs over a broader set of issues, and we expect that to endure moving forward.

Ryan Luby: Part of what’s most interesting over the last three years from a labor market perspective, it’s in some sense how much the bargaining space between employees and employers has opened up. Historically, and this is a little bit stylized, employees and employers have basically bargained over wages and hours. It’s been interesting over the last few years it’s been you have wages and hours, it’s table stakes, but you now have flexibility in terms of where, when, how is work performed. And I think as we think about what that means, it’s just a very nice framing for thinking about flexibility, which includes the built environment and the extent to which it seamlessly creates and facilitates flexibility across a workforce. The extent to which that does act as a competitive advantage in an increasingly tight talent and labor market. I think that’s part of the piece that we really see enduring is coming out of over the next 10 or 15 years. A world in which the bargaining space between employees and employers is more dynamic, occurs over a broader set of issues, and we expect that to endure moving forward.

The Rise of Independent Work (02:35)

Ryan Luby: At the same time that we’ve seen an explosion of flexible work over the last three years, we’ve seen in parallel a real acceleration in the adoption of independent work. These are flexible, freelance, contract, contractor models and we estimate that this is on the order of 30 to 40% of the US labor force. It’s a huge structural change on the order of economic and social import that we think about assigning to increased female labor force participation following World War II. It’s a pretty natural compliment to the flexibility that we’re seeing from a workplace side in terms of where and when work is performed. The rise of independent work (there is a natural pairing there) and we think there are interesting implications for how we think about work being segmented, assigned and ultimately performed.

Ryan Luby: At the same time that we’ve seen an explosion of flexible work over the last three years, we’ve seen in parallel a real acceleration in the adoption of independent work. These are flexible, freelance, contract, contractor models and we estimate that this is on the order of 30 to 40% of the US labor force. It’s a huge structural change on the order of economic and social import that we think about assigning to increased female labor force participation following World War II. It’s a pretty natural compliment to the flexibility that we’re seeing from a workplace side in terms of where and when work is performed. The rise of independent work (there is a natural pairing there) and we think there are interesting implications for how we think about work being segmented, assigned and ultimately performed.

The Bar Is Very High (03:37)

Phil Kirschner: The average American commutes maybe an hour, and most of us who don’t have that hour, we’ll kind of split the time with our employers. So we’ll give you an extra half hour and it’ll take a half hour for me. It really puts just how much time that is on the table. But said the inertia is so strong, or rather lack of inertia when we were just sat at home at every little extra step, every little point of friction along the way just makes it easier to be like, ‘don’t want to’. So the bar is very, very, very high if you want to get me not only out of my chair and out of my front door, but back to the ecosystem, common era passed dozens of other things that may either informally or formally be workplaces.

Phil Kirschner: The average American commutes maybe an hour, and most of us who don’t have that hour, we’ll kind of split the time with our employers. So we’ll give you an extra half hour and it’ll take a half hour for me. It really puts just how much time that is on the table. But said the inertia is so strong, or rather lack of inertia when we were just sat at home at every little extra step, every little point of friction along the way just makes it easier to be like, ‘don’t want to’. So the bar is very, very, very high if you want to get me not only out of my chair and out of my front door, but back to the ecosystem, common era passed dozens of other things that may either informally or formally be workplaces.

There’s been an explosion in the supply of formal and informal, flexible third place coworking workspaces. Every community center, every library, every coffee shop, everywhere you can sit here. So the magnet has to be strong enough not just to get me out of my house, but to keep my blinders on past all of those other things all the way back to the workplace my employer may be trying to get me to go to.

Where Did the Labor Go? (04:57)

Ryan Luby: I think it’s important and instructive in this context to take a step back and look at the broader set of supply side trends within the US labor market to get a sense of sort of where we’re headed. And structurally from the supply side, we see a set of four core drivers, which we expect to keep our labor market relatively tight. The first one is aging demographics. You have the wealthiest generation in human history entering retirement. You’ve got a combination of physical healthcare and mental healthcare, and the physical healthcare is not only covid related that are holding people on the sidelines. You have childcare which takes people who are at peak productivity and peak productivity growth. You can measure that in terms of wages, often holding them on the sidelines. And then the fourth piece is reduced immigration. You put those four pieces into context and you compliment that with the secular demand side drivers that we have coming through a range of things like the stimulus bill, aging healthcare, and the tailwinds around aging demographics. You’re in a situation in which you have constrained supply as cyclical demand coming down the pipe. This really creates a context in which we’d expect labor to be constrained moving forward. And it has important implications then for the persistence of hybridity and the bargaining space over which employers and employees negotiate. We think moving forward is not only hours and wages, it also will include a component around flexibility, which we expect to endure moving forward.

Ryan Luby: I think it’s important and instructive in this context to take a step back and look at the broader set of supply side trends within the US labor market to get a sense of sort of where we’re headed. And structurally from the supply side, we see a set of four core drivers, which we expect to keep our labor market relatively tight. The first one is aging demographics. You have the wealthiest generation in human history entering retirement. You’ve got a combination of physical healthcare and mental healthcare, and the physical healthcare is not only covid related that are holding people on the sidelines. You have childcare which takes people who are at peak productivity and peak productivity growth. You can measure that in terms of wages, often holding them on the sidelines. And then the fourth piece is reduced immigration. You put those four pieces into context and you compliment that with the secular demand side drivers that we have coming through a range of things like the stimulus bill, aging healthcare, and the tailwinds around aging demographics. You’re in a situation in which you have constrained supply as cyclical demand coming down the pipe. This really creates a context in which we’d expect labor to be constrained moving forward. And it has important implications then for the persistence of hybridity and the bargaining space over which employers and employees negotiate. We think moving forward is not only hours and wages, it also will include a component around flexibility, which we expect to endure moving forward.

Less Office Space Required (06:54)

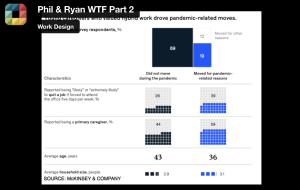

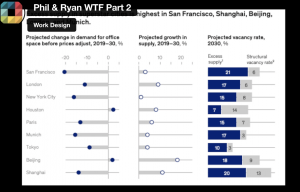

Ryan Luby: Across the nine cities in scope that we studied, we estimate a reduction in value or a value at stake of $800 billion through 2030. Quite material decline, and that reflects roughly a 13% reduction in square footage demand moving forward. It broadly reflects three components on the workplace demand side. It reflects shifting attendance patterns. On average, we see folks moving. We expect folks to attend the office three and a half days per week moving forward. Variation across sector, firm size and geography. We also overlay dynamics there around collaboration or coordination among those who are attending the office. We see peak attendance Tuesday to Thursday, so people tend to be coming in the office together, which reduces the hit that attendance creates. And then the final piece is continuing a pre pandemic trend that we observed is continued densification within the workplace as folks attend the office in order to really be there for moments that matter, that involves less heads down cubicle work, more collaborative activity, which tends to be denser. When you take those three pieces: attendance, coordination, and densification, we estimated in the median city a 13 percentage point reduction in demand out to 2030.

Ryan Luby: Across the nine cities in scope that we studied, we estimate a reduction in value or a value at stake of $800 billion through 2030. Quite material decline, and that reflects roughly a 13% reduction in square footage demand moving forward. It broadly reflects three components on the workplace demand side. It reflects shifting attendance patterns. On average, we see folks moving. We expect folks to attend the office three and a half days per week moving forward. Variation across sector, firm size and geography. We also overlay dynamics there around collaboration or coordination among those who are attending the office. We see peak attendance Tuesday to Thursday, so people tend to be coming in the office together, which reduces the hit that attendance creates. And then the final piece is continuing a pre pandemic trend that we observed is continued densification within the workplace as folks attend the office in order to really be there for moments that matter, that involves less heads down cubicle work, more collaborative activity, which tends to be denser. When you take those three pieces: attendance, coordination, and densification, we estimated in the median city a 13 percentage point reduction in demand out to 2030.

Activated Communal Work (08:37)

Ryan Luby: When we look at the valuation and attendance numbers linked to class A, B, and C, we actually see broad-based decline across the board. It’s only when you look at this particular subset of class A, which you think about as you could call it trophy or magnet, do we see really persistent levels, high levels of attendance? And the characteristics of those offices are, they share some of class A’s characteristics, but the vast majority of class A office stock, which was built pre pandemic, is not geared towards the kind of activated communal work that we see as a real imperative to empower flexibility moving forward. What that means for class B and class C stock, these are portions of the market that are going to require really material capex to update them to create places where people really want to be. And there are some structural things which can be updated that you can invest in capex, but core things like location are much more difficult to change. So something that’s class B and class C in a suburban office park where commuters on average need to travel in 60 or 90 minutes, that’s going to be structurally impaired in a way that Class B office stock in a city at the hub of several transit corridors that class B and class C stock is more fixable.

Ryan Luby: When we look at the valuation and attendance numbers linked to class A, B, and C, we actually see broad-based decline across the board. It’s only when you look at this particular subset of class A, which you think about as you could call it trophy or magnet, do we see really persistent levels, high levels of attendance? And the characteristics of those offices are, they share some of class A’s characteristics, but the vast majority of class A office stock, which was built pre pandemic, is not geared towards the kind of activated communal work that we see as a real imperative to empower flexibility moving forward. What that means for class B and class C stock, these are portions of the market that are going to require really material capex to update them to create places where people really want to be. And there are some structural things which can be updated that you can invest in capex, but core things like location are much more difficult to change. So something that’s class B and class C in a suburban office park where commuters on average need to travel in 60 or 90 minutes, that’s going to be structurally impaired in a way that Class B office stock in a city at the hub of several transit corridors that class B and class C stock is more fixable.

Phil Kirschner: And that kind of well located fixer upper class B building was certainly in my time, they very much the target for companies like WeWork, they were like, we can activate, we can take something that’s got good bones in a good location and change the design, bring in technology and activate and make something that’s compelling or maybe as compelling as the trophy, trophy super class A building across the street but even the ones that are brand new from a structural perspective and beautiful and efficient and well located, as Ryan said, don’t necessarily have the sort of community feel and sort of like a vertical network, vertical village activation digital layer that I think the most compelling magnetic buildings have. Even just at the lobby level, there are some buildings now like you walk in, it still feels like a building lobby in the sense of big security desk and a sort of primary facial expression from someone who works in the lobby, which is guilty until proven innocent, right? ‘My job is to block you from this building’. And then there are others that take you much more from kind of retail and hospitality where if you walked in there accidentally going into the wrong building, you might not immediately know it’s an office building. Just because of the layout, the flow, how someone who works there treats you, what you see first and that’s hard to change if it wasn’t designed that way. And it’s creating a material difference in the experience.

Learn and Adapt (11:51)

Phil Kirshner: Most of our offices didn’t have a purpose before and you need to find yours. What is setting a north star vision for the role that place has for your company, both holistically and then at the kind of building level, right? Because you may be a company that manufactures some kind of goods and therefore place both supports your regular office workers, but also is where you make things and the purpose of a factory is very different than a purpose of an office, but you need some prevailing principles that are clear enough for all employees, all typologies to embrace, but not so specific that they’re exclusionary of any individual site. Once you then have gotten to the site level of identifying the purpose, the best practice is to understand there will not be a fixed answer to this very flexible problem so you have to put in a muscle for responsiveness, reaction to feedback, test, learn, fail fast, pilot, scale, what works, and not just in the built environment like the desks and the walls, but the technology that you’re using, the work processes that employees are following and that’s a hallmark of the companies who are the most successful in this transformation. Companies willing to say, we’re going to try a lot of stuff and see what works and call failures when we see that, and that leads to the last stage, which is really making sure that this is data-driven going forward, has executive level insight and that you’ve got someone who is ultimately accountable for what it feels like to work in this place with the authority to make changes. And if you can commit to the employees, this is not change management in the old way of, I go from point A to point B, this is now like a mindset and a muscle.

Phil Kirshner: Most of our offices didn’t have a purpose before and you need to find yours. What is setting a north star vision for the role that place has for your company, both holistically and then at the kind of building level, right? Because you may be a company that manufactures some kind of goods and therefore place both supports your regular office workers, but also is where you make things and the purpose of a factory is very different than a purpose of an office, but you need some prevailing principles that are clear enough for all employees, all typologies to embrace, but not so specific that they’re exclusionary of any individual site. Once you then have gotten to the site level of identifying the purpose, the best practice is to understand there will not be a fixed answer to this very flexible problem so you have to put in a muscle for responsiveness, reaction to feedback, test, learn, fail fast, pilot, scale, what works, and not just in the built environment like the desks and the walls, but the technology that you’re using, the work processes that employees are following and that’s a hallmark of the companies who are the most successful in this transformation. Companies willing to say, we’re going to try a lot of stuff and see what works and call failures when we see that, and that leads to the last stage, which is really making sure that this is data-driven going forward, has executive level insight and that you’ve got someone who is ultimately accountable for what it feels like to work in this place with the authority to make changes. And if you can commit to the employees, this is not change management in the old way of, I go from point A to point B, this is now like a mindset and a muscle.

We’re just entering a new cycle as we think of our consumers, right? Consumer pattern retail pattern is not static so we’re always looking to learn from those experiences. We are applying the same thing. So the north star vision with a clearly defined purpose for the place, which then lets you articulate the moments that matter, why people should want to come in and therefore why they shouldn’t feel compelled that they have to come in, and putting in as much of a operating system as you can for measuring every little bit about how we feel, where we go, what’s getting used, who we are, all of it so that you could learn and scale the things that work and back off from those don’t.

We Have an Opportunity (14:31)

Ryan Luby: Historically, the challenge of growing in these urban cores and driving equity, creating growth in these areas has been the lack of space. We now have space. We have a moment to reinvent, but I think there is a component here where we need to lift our aspiration and be sort of a little bit more imaginative about the types of places that we could create in cities. And so thinking about things when Phil talked about these quite eloquently, thinking about things like magnetic retail space, thinking about vertical farming, really sort of taking the blinders off and using now as an opportunity to work with what historically has been one of the scarcest resources: space in cities. And I think there’s an opportunity where we can activate and create something special and enduring moving forward.

Ryan Luby: Historically, the challenge of growing in these urban cores and driving equity, creating growth in these areas has been the lack of space. We now have space. We have a moment to reinvent, but I think there is a component here where we need to lift our aspiration and be sort of a little bit more imaginative about the types of places that we could create in cities. And so thinking about things when Phil talked about these quite eloquently, thinking about things like magnetic retail space, thinking about vertical farming, really sort of taking the blinders off and using now as an opportunity to work with what historically has been one of the scarcest resources: space in cities. And I think there’s an opportunity where we can activate and create something special and enduring moving forward.

What’s Next (15:32)

Phil Kirschner: On the whole, I think this is a really exciting time and I am optimistic that we’re starting to see a shift in focus, not just on the presence like productivity through presence, but looking at outputs and outcomes. And not just on offering flexibility to workers or saying we will have flexible working, but rather doing the more difficult but much more beneficial work from an organizational health perspective of creating the conditions wherein flexibility is possible. So that means leaning into automation, evaluating our work process, really re-imagining things like meeting culture, lots of stuff that’s been broken for a long, long time. And if we do that work, it will allow us to work in a more remote and distributed way for the business as usual, boring stuff. And I think let the natural human tendency take over of wanting to be together for the moments that actually matter, building social capital and connection with our employees and mentoring, learning, even just the true social element of being with coworkers, knowing that the core of our work doesn’t rely on being next to each other factory style like we thought it might have 30 or 40 years ago.

Phil Kirschner: On the whole, I think this is a really exciting time and I am optimistic that we’re starting to see a shift in focus, not just on the presence like productivity through presence, but looking at outputs and outcomes. And not just on offering flexibility to workers or saying we will have flexible working, but rather doing the more difficult but much more beneficial work from an organizational health perspective of creating the conditions wherein flexibility is possible. So that means leaning into automation, evaluating our work process, really re-imagining things like meeting culture, lots of stuff that’s been broken for a long, long time. And if we do that work, it will allow us to work in a more remote and distributed way for the business as usual, boring stuff. And I think let the natural human tendency take over of wanting to be together for the moments that actually matter, building social capital and connection with our employees and mentoring, learning, even just the true social element of being with coworkers, knowing that the core of our work doesn’t rely on being next to each other factory style like we thought it might have 30 or 40 years ago.

Key Takeaways:

- Hybrid work is here to stay. As a result, office attendance has stabilized at 30 percent below prepandemic norms.

- The ripple effects of hybrid work are substantial. Untethered from their offices, residents have left urban cores and shifted their shopping elsewhere. For example, New York City’s urban core lost 5 percent of its population from mid-2020 to mid-2022, and San Francisco’s lost 7 percent. Urban vacancy rates have shot up. Foot traffic near stores in metropolitan areas remains 10 to 20 percent below prepandemic levels.

- Demand for office and retail space in superstar cities will remain below prepandemic levels. In a moderate scenario that we modeled, demand for office space is 13 percent lower in 2030 than it was in 2019 for the median city in our study. In a severe scenario, demand falls by 38 percent in the most heavily affected city.

- Real estate is local, and demand will vary substantially by neighborhood and city. Demand may be lower in neighborhoods and cities characterized by dense office space, expensive housing, and large employers in the knowledge economy.

- Cities and buildings can adapt and thrive by taking hybrid approaches themselves. Priorities might include developing mixed-use neighborhoods, constructing more adaptable buildings, and designing multiuse office and retail space.

Resources:

- “Empty spaces and hybrid places: The pandemic’s lasting impact on real estate”

- “Is your workplace ready for flexible work? A survey offers clues”

- American Opportunity Survey: “Americans are embracing flexible work—and they want more of it”

- “The State of Organizations 2023:Ten shifts transforming organizations”

- Global Balance Sheet Report: “The future of wealth and growth hangs in the balance”

Meet Phil Kirschner

Phil is a senior expert and associate partner in the firm’s Real Estate and People & Organizational Performance Practices. He has led multiple large-scale workplace transformations, and is passionate about measuring the outcomes of workplace design, occupancy, and activation choices on business objectives and employee experience.

Phil is a senior expert and associate partner in the firm’s Real Estate and People & Organizational Performance Practices. He has led multiple large-scale workplace transformations, and is passionate about measuring the outcomes of workplace design, occupancy, and activation choices on business objectives and employee experience.

Examples of his recent work include the following:

- empowering members of the post-COVID-19, future-workplace planning team for a Fortune 500 technology company by developing employee journeys, workplace configuration benchmarks, flexible office and coworking strategies, and remote-working policies

- inspiring the teleworking and workplace-mobility transformation of a major US state agency through creation of a “north star” vision, increasing capacity of a new headquarters by 30 percent, introducing new collaboration tools, and fostering a culture of increased innovation and risk taking

- leading the executive and employee discovery activities to define a “footprint for the future” for the corporate headquarters of a real-estate developer with $45 billion in assets under management; redesigned the employee and client experience, embedded a community-connection team and “living lab” for piloting new workplace technologies

Prior to McKinsey, Phil had 20 years of experience across the disciplines of information security, operational risk, expense management and corporate real estate. His workplace strategy career began when he co-created an industry-leading “smart working” program for a global financial-services firm that improved employee engagement, reduced voluntary attrition, and increased building capacity for over 15,000 staff in seven countries.

Meet Ryan Luby

Ryan Luby is a Senior Knowledge Expert and Associate Partner at McKinsey & Company. A leader of the McKinsey Global Institute (MGI), Ryan leads MGI’s applied research on macroeconomics in North America. His recent work includes a dynamic view of economic sentiment via the American Opportunity Survey, with an eye towards understanding the impact on the most vulnerable populations. In addition, he drives McKinsey’s perspective at the intersection of labor markets and real estate, including a view on labor shortage along the construction value chain. Ryan serves clients along the real estate value chain, in the public sector, and investors. He partners with clients to understand the macro forces shaping their operating environment and developing actionable, go-forward perspectives.

Ryan Luby is a Senior Knowledge Expert and Associate Partner at McKinsey & Company. A leader of the McKinsey Global Institute (MGI), Ryan leads MGI’s applied research on macroeconomics in North America. His recent work includes a dynamic view of economic sentiment via the American Opportunity Survey, with an eye towards understanding the impact on the most vulnerable populations. In addition, he drives McKinsey’s perspective at the intersection of labor markets and real estate, including a view on labor shortage along the construction value chain. Ryan serves clients along the real estate value chain, in the public sector, and investors. He partners with clients to understand the macro forces shaping their operating environment and developing actionable, go-forward perspectives.

Recent experience includes the following:

- Leads McKinsey’s thinking on labor markets, with recent publications around labor shortage, flexible work, independent work, economic mobility, and economic inclusion

- Leads McKinsey’s thinking on real estate, with recent publications on the evolving demand for real estate in the post-pandemic context and the impact of rising inflation on returns

- Partner with public sector at the federal, state, and local levels to respond to the most important macro challenges

- Partner with corporates and investors who are at the leading edge of creating the future of work through labor markets and the built environment

Episode 6 Part 2 Credits:

- Created By Bob Fox

- Produced By Work Design Magazine

- Directed By Bob Fox

- Edited By Katie Sargent & Bob Fox

- Special Thanks to Vero Henze